Tax Override

Connected Business POS can process sales that are generated by multiple sales channels, including transactions from the web store or other physical locations. If the default tax code configured within a POS setup is not applicable to a sales transaction, you can change the settings to enable the tax override feature.

This feature can only be performed if the account signed into POS is an Administrator. If another user role is signed into POS, this setting will not be viewable.

This feature is only available in Connected Business v15 and higher.

Set Up Tax by Location

On the POS starting screen, tap the Settings icon to display the list of setting control. Under the General category, find the setting labeled Tax by Location. Depending on your preferences you can turn this function on or off.

-

ON – If this setting is enabled, POS will automatically apply the tax code created for the POS location.

-

OFF – If this is disabled there will be no sales tax automatically applied to processed transactions.

Click Image to Enlarge

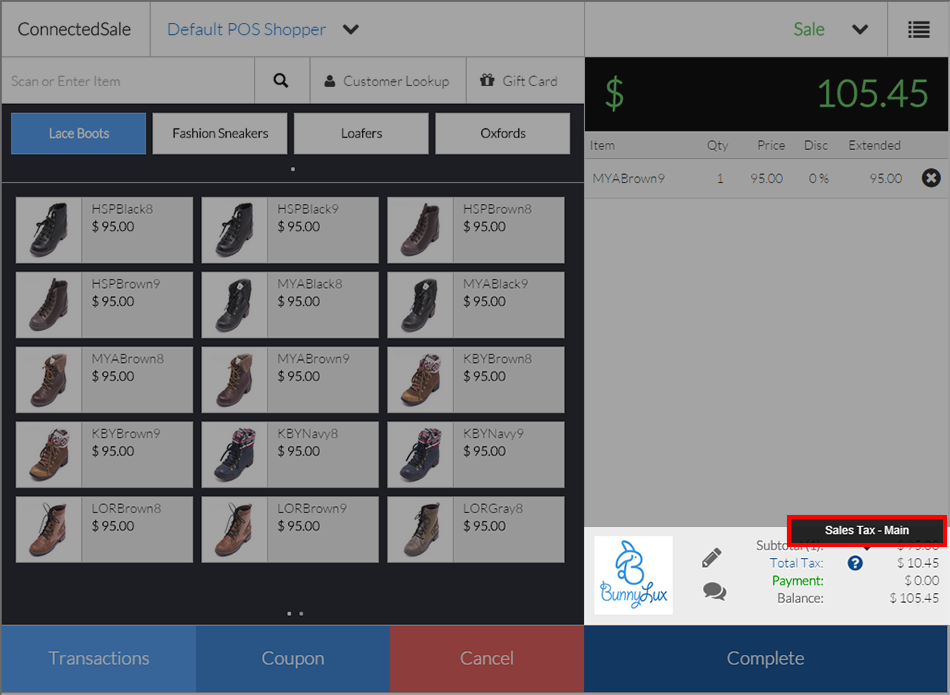

To find out which tax code is currently applied to the transaction, go to the sales register and look for the price breakdown on the right side of the screen. Tap on the question mark icon (?) located beside the line item labeled Total Tax.

A dialog box will appear, showing the name of the currently applied tax code.

Click Image to Enlarge

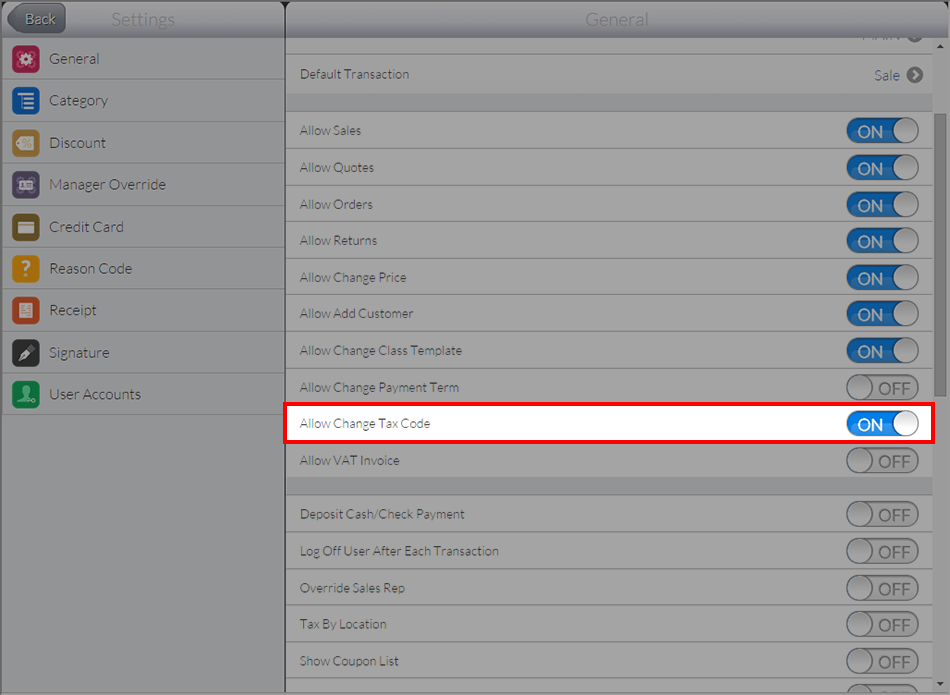

Allow Change Tax Code

To allow for tax code changes while processing sales, you need to go to Settings and search for the control labeled Allow Change Tax Code. Turn the controls ON to enable the POS to assign different tax codes.

Click Image to Enlarge

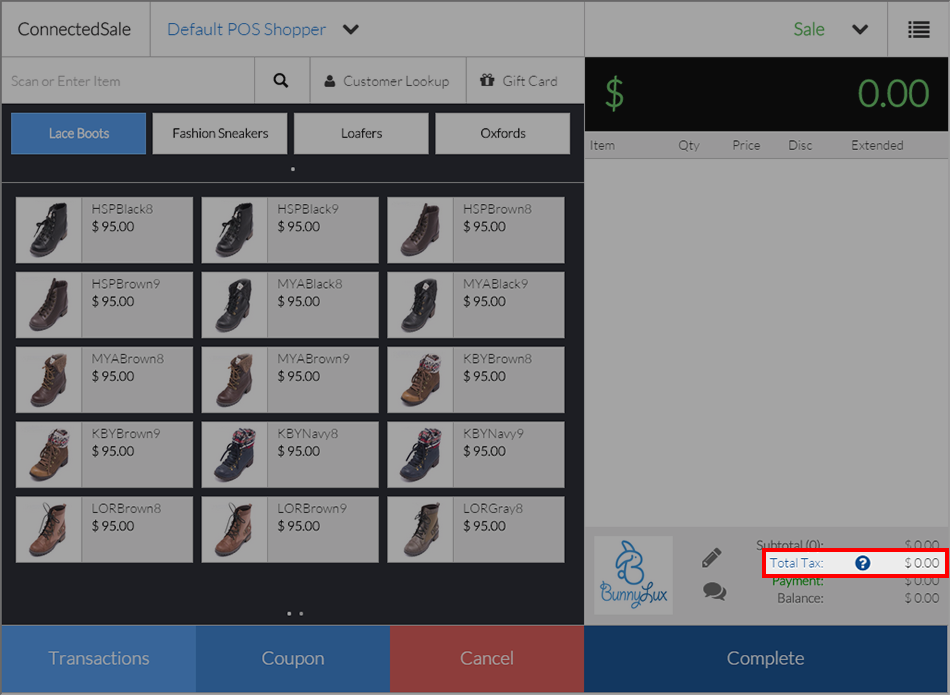

If this setting is enabled, you click on the line item labeled Total Tax located at the bottom right corner of the screen.

Click Image to Enlarge

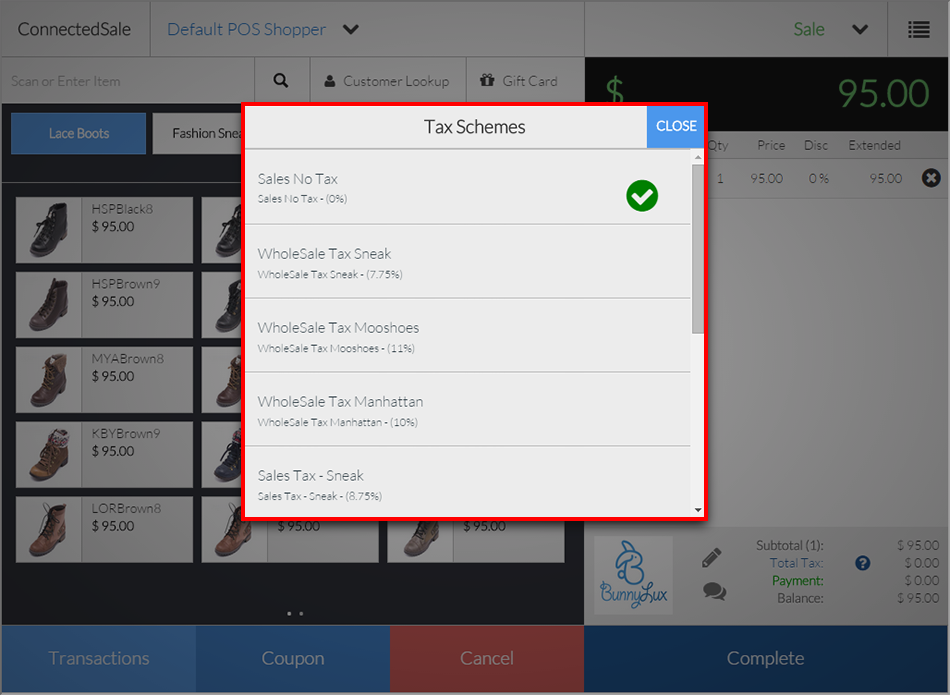

Tapping the total tax link will display the Tax Schemes dialog box. This is a list of the tax schemes pre-programmed into the Connected Business system.

Click Image to Enlarge

Choose the tax code by scrolling through the list and tapping on the correct scheme. You can then proceed with your sales transaction.